...

News

Docent raises 5 million euros

Congratulations to the entire Docent team for securing a €5M in order to revolutionize the discovery and collection of contemporary art through artificial intelligence!Founded in 2020 by Hélène Nguyen...

Docent raises 5 million euros

Congratulations to the entire Docent team for securing a €5M in order to revolutionize the discovery and collection of contemporary art through artificial intelligence!

Founded in 2020 by Hélène Nguyen-Ban and Mathieu Rosenbaum, Docent is an art-tech startup bridging the realms of art and AI.

It facilitates the digitalization of the contemporary art world by connecting artists, galleries, and collectors (enthusiasts or amateurs) worldwide for a unique artistic experience.

The concept: empower everyone to break free from their artistic comfort zones by encouraging exploration and discovery beyond their horizons. 🚀

To achieve this, the startup has pioneered a unique collaboration between AI researchers and art historians to develop proprietary algorithms (Machine Learning, Computer Vision, NLP) capable of recommending artworks based on individual preferences, aesthetics, artistic trends, or creative contexts.

Today, in partnership with 150 international galleries, over 20,000 unique works by 2,000 artists, ranging from €500 to €500,000, are showcased.

Polytechnique Ventures invests in Jimmy Energy

Jimmy Energy is a provider of carbon-free process heat. The company designs and operates industrial heat generators based on high-temperature nuclear microreactor (HTR) technology. The micro-reactors ...

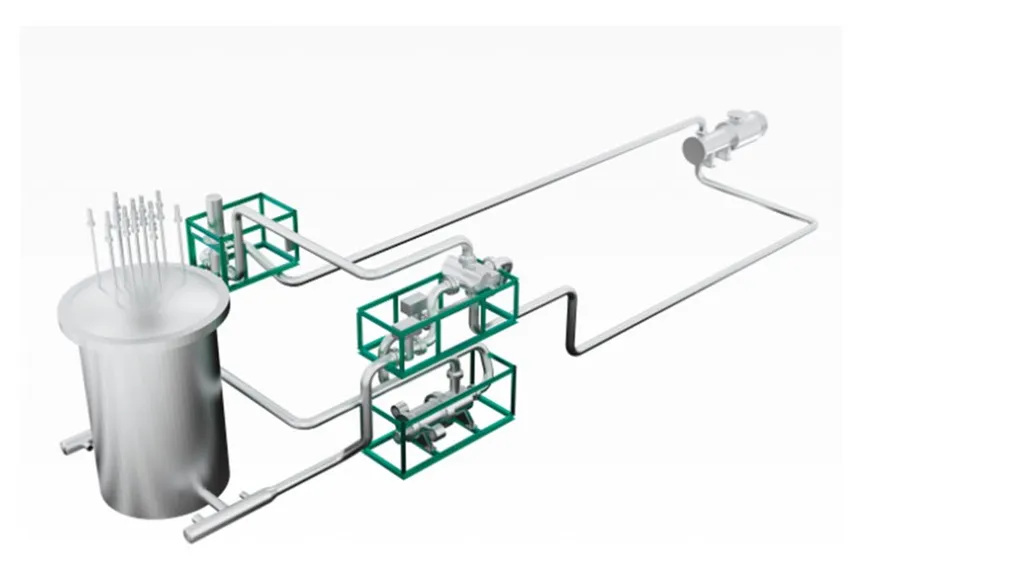

Polytechnique Ventures invests in Jimmy Energy

Posted by Gaspard Devissaguet on February 10, 2022

Jimmy, the new "decarbonised industrial heat supplier" is accelerating its development and today announced a €2.2 million Seed round with EREN Industries, Noria, Otium Capital, Polytechnique Ventures and "Friends & Family" investors.

On Thursday 10 February, Antoine Guyot, co-founder and CEO of Jimmy energy, spoke about the replacement of energy-hungry thermal burners by low-carbon mini-reactors on the Good Morning Business programme presented by Sandra Gandoin and Christophe Jakubyszyn.

Creation of Polytechnique Ventures, an investment fund for X alumni

Polytechnique Ventures, an investment fund created on the initiative of the École Polytechnique Alumni, was launched today to strengthen the entrepreneurship and innovation ecosystem at X.The Polytech...

Creation of Polytechnique Ventures, an investment fund for X alumni

Posted by Polytechnique Ventures on juillet 7, 2021

The Polytechnique Ventures fund is the result of the Alumni's desire to support the School's dynamics in technological entrepreneurship, and X's desire to have a professional financing tool backed by its incubator. It will create strong synergies between Alumni and high-potential young companies.

In order to extend X's actions in terms of entrepreneurship, the fund will invest in the emergence and growth of innovative companies, thus contributing to structuring the School's ecosystem and strengthening its international appeal. The start-ups financed and supported will be selected from among the projects emerging from the X ecosystem. They must be founded by one or more alumni of the School (engineering degree, Bachelor's degree, Master's degree, Executive Education, Doctorate, post-doctorate), incubated by the School (within X-Up or X-Tech), or emanating from the laboratories.

Focused on early stage financing, in co-investment, Polytechnique Ventures' investment strategy is based on average initial tickets of €250K to €500K in pre-seed and seed, and the desire to continue in series A, up to an average ticket of €2.5m per company. The main criteria will be the quality of the founding team, the uniqueness of the technologies implemented, the development potential of the company and its societal contribution. Priority will be given to ambitious deep tech projects, capable of profoundly transforming the targeted industrial sectors. Polytechnique Ventures will thus be able to rely on the accumulated experience of the Alumni network, and on the School's research, innovation and teaching community to support the entrepreneurs.

Polytechnique Ventures, advised by Polytechnique Ventures SAS and managed by Equitis Gestion, announces that it has raised €20m to date, with a final target of €30m to €40m. The fund's first two investments have been made in the companies

- Néolithe, which specialises in recycling construction waste into environmentally-friendly aggregates

- Okomera, a specialist in prognostic tools for precision medicine in oncology.

For Eric Labaye, President of the École Polytechnique, "This fund will be a major accelerator for the development of start-ups in our incubator and I am very happy that the alumni are mobilising to support the formidable entrepreneurial and innovative dynamic of the École Polytechnique. École Polytechnique thus joins most of the major international institutions of higher education in offering an indispensable lever for attracting and supporting the best entrepreneurs.

For Denis Lucquin, President of Polytechnique Ventures SAS, Partner and former President of Sofinnova Partners, "The origins of Polytechnique Ventures lie in the idea of engaging alumni with young entrepreneurs from the École's ecosystem. A wealth of experience at the service of a multitude of initiatives. Thanks to the exceptional breeding ground of innovations that emanate from X, this entrepreneurial, industrial and financial community aims to support the emergence of talented entrepreneurs and successful companies, which meet the technological, environmental and societal challenges of tomorrow's world."

Presentation of the fund - Polytechnique Ventures

Video presentation of the fund by Eric Labaye, President of Ecole Polytechnique and Denis Lucquin, President of Polytechnique Ventures and Partner and former President of Sofinnova Partners....